This comic was made by Bill Watterson some 20 years ago. I said it once, and I'll say it again: Calvin and Hobbes was way ahead of its time.

The Road to Financial Freedom Starts Here!

▼

Wednesday, February 29, 2012

Tuesday, February 28, 2012

Why It Does Not Pay to Work for (or Be) an Asshole Boss

I'm sure a lot of us have this notion that being an ass and financial success go hand in hand. I personally know at least a couple of highly accomplished executives and business persons who get away with "conduct unbecoming of a gentleman" either because people believe that bad behavior is a key ingredient of success, or that successful people are simply entitled to occasional bouts of temper tantrums and acts of boorishness. Regardless of how the misguided majority regard the behavior of "bad bosses," I have always had this firm belief that there is rarely a valid excuse for shouting at or humiliating a subordinate or employee. So I guess this recent study which shows how the bad behavior of bosses negatively impact the lives of all involved just proves my point.

The study specifically demonstrates that YES, the more negatively bosses acted towards their employees, the less happy these employees were. Also, when bosses were controlling rather than encouraging, employee well-being was low. On the other hand, the overall well-being of employees was better when they felt that their autonomy was encouraged. In summary, we can tell from these results that employee happiness and well-being are significantly affected by the management style of the boss, and that this places an additional toll on the already limited monetary and non-monetary benefits that the typical rank and file gets from the job.

Overall these findings may not be very surprising, but that does not make them any less important. If you're an employee who works for an asshole boss, you now have scientifically-backed reasons to look for another job soon. If you're the asshole boss, do you really think whatever satisfaction you get from being an ass is worth the cost to your employees and organization?

via The Atlantic

Sunday, February 26, 2012

Managing Your UITFs and Mutual Funds, Part 2: Dissecting Bloomberg's Portfolio Tracker and Fund Snapshot

This post is a response to the request of one of our readers, Anonymous.

SYMBOL NAME - List of Bloomberg ticker symbols of the contents of your portfolio. Please note that these are different from the symbols used by fund providers and the PSE (in the case of stocks).

The following four quantities fall under the TODAY header of the display and thus pertain to the current or latest trading period.

PRICE - The last reported price of the components of your portfolio. The NAVPU and NAVPS of UITFs and mutual funds are quoted only once per day, unlike stock prices which are quoted in real time (delayed by 15 minutes).

CHANGE - The change in the per unit or per share value of the fund or stock in the current or latest trading period.

LAST TRADE - Dates (and times for stocks) of the last quoted prices.

GAIN/LOSS - The monetary gain or loss for each portfolio component in the current or latest trading day, excluding transaction costs for stocks.

The succeeding quantities fall under the SINCE PURCHASED header and pertain to the period from when you bought a portfolio component up to the current or latest trading date.

SHARES - The number of units or shares of each component that you own. You specify this when you construct and edit your portfolio.

PRICE PAID - The price you paid for each unit or share of your portfolio components.

PURCHASE DATE - I'm sure you'll be offended if I even try to explain what this means.

GAIN/LOSS - The monetary gain or loss for each portfolio component from the Purchase Date up to the current or latest trading day, excluding transaction costs for stocks.

% CHANGE - The percent change in the value of each portfolio component from the Purchase Date up to the current or latest trading day, not reflecting transaction costs for stocks.

% PORT - The weight of each component of your portfolio based on the last quoted price.

VALUE - The total value of each component and the entire portfolio based on the last quoted price.

Clicking the link of a fund will take you to its "snapshot" page which contains information that we may or may not be familiar with. As per Anonymous' request, I will identify and describe some of the more important features of this page.

A. BLOOMBERG TICKER SYMBOL of the fund, as described above

B. PRICE, same as above

C. CHANGE and % CHANGE, same as above. A "down" arrow and the color red indicates a decrease in the per unit/share price from the previous trading day, while an "up" arrow and the color green means an increase.

D. PRICE CHANGES for the indicated periods. Year To Date means from January 1 of the current year up to the current/latest trading day; 1-Month, 3-Month, and 1-Year for the total price change in the past month, three months, and 12 months, respectively; 3-Year and 5-Year for the annualized change (geometric change per year) in price in the past three and five years, respectively.

E. 52-WEEK RANGE - the lowest and highest prices in the past 12 months

F. BETA - a measure of the volatility (in financial theory, also systematic or market risk) of the fund relative to a relevant benchmark (e.g., the PSEi for equity funds and stocks). A beta that is greater than one means that the fund is more volatile than the benchmark; a beta that is less than one (but greater than zero) means that the fund is less volatile than the benchmark.

And for this section:

NAV - same as PRICE above

FRONT LOAD - Percentage of the investment amount that you must first pay to buy the fund

BACK LOAD - Percentage of the total value of your investment that you must pay upon redeeming/selling units/shares

CURRENT MANAGEMENT FEE - Also know as TRUST FEE, the percentage of the fund value that you pay every year for the professional management of your capital

REDEMPTION FEE - specifically early redemption fee, it's the percentage of the fund value that you pay if you redeem/sell units/shares within the minimum holding period (differs per fund/fund type; please see this post for examples)

12B1 FEE - This. Usually not quoted for Philippine funds anyway.

EXPENSE RATIO - The fund's annual operating costs (including the management fee) relative to the fund's total value

Wednesday, February 22, 2012

Had We Been Had by "Rich Dad, Poor Dad"?

I guess, in a sense, one could say that my interest in business and finance began when I read Robert Kiyosaki's best-selling personal finance book, Rich Dad, Poor Dad, almost a decade ago. Back then, a lot of the things Mr. Kiyosaki said made a lot of sense to me: I completely bought in to the idea that the only way make it "big" and get out of "the rat race" is to earn passive income from investments and/or from running your own business. Come to think of it, I guess I still do believe in these things, perhaps even more so now than ten years ago.

However, I do recall a few things about the book that struck me as odd. For example, I had this uneasy feeling that Kiyosaki made things seem simpler and easier than they are, in truth. And I didn't really like it when he made counter-intuitive points just for the sake of making a counter-intuitive point, or when he tried to seem "wise" by superficially challenging conventional wisdom. Like how he refers to a car as a liability and not an asset: while he does make valid points about how a car costs money to maintain and loses value over time--thus a "liability" in common usage--he misleads and confuses readers by not making a distinction between this definition and the accounting definition of the term.

Ultimately, criticisms against Mr. Kiyosaki and his philosophy center on the limitations and shortfalls of his advice. As this old Wall Street Journal article discusses, much of what Kiyosaki passes off as "financial advice" may be found wanting in terms of theory and common sense, and some even contradict his personal experiences in business and investing. Nevertheless, those who have read one or some of his books would agree that the basic premise of the Rich Dad, Poor Dad philosophy does make sense and would be an effective source of motivation for a lot of people.

Perhaps not even Mr. Kiyosaki will deny that he makes a substantial amount of money from Rich Dad, Poor Dad and everything that is associated with it. There's nothing wrong with that--it's his intellectual property and a lot of people are willing to pay a small amount to find out what he has to say. However, when entities that are associated with him and who are legally entitled to using the Rich Dad, Poor Dad name start extorting thousands of US (Canadian) dollars from ordinary citizens who just want to learn how to improve their lives, we should begin to question the credibility of Mr. Kiyosaki's operation and the sincerity of his intentions. Watch this investigative video from CBC News and you be the judge.

Monday, February 20, 2012

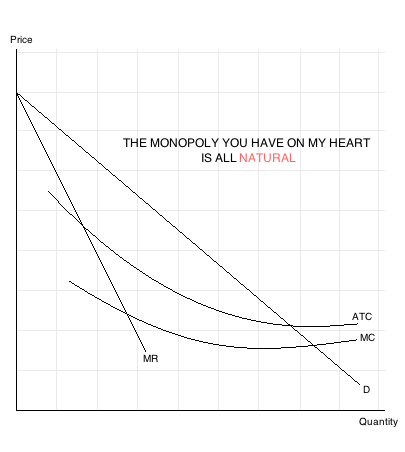

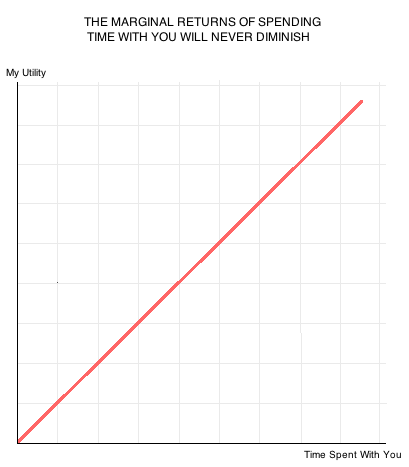

14 Ways an Economist Says I Love You (A Very Belated Valentine Post)

Wednesday, February 15, 2012

11 Financial Ratios, Part 2: Debt Management and Profitability Ratios

PERSONAL FINANCE 101

In Part 1, we took a look at financial ratios that we can use to assess the capacity of a firm to meet its short-term obligations and its ability to use its resources to generate revenues. In this post, we will discuss ratios that we can use to evaluate the firm's ability to meet long-term financial obligations and earn returns from investments.

Debt management ratios

7. Debt ratio = total liabilities / total assets OR total long-term debt / total assets

The debt ratio, also often referred to as financial leverage, is simply a measure of how the firm's assets are financed. If you recall from our post about the balance sheet, a business has two main sources of long-term financing: debt and shareholders' equity (i.e., capital provided by the firm's owners). A high debt ratio indicates that a big portion of the firm's assets is financed by debt--which is really neither "good" nor "bad". To a great extent, a firm's debt level depends on its industry as some business models do well on little debt while others thrive on a higher financial leverage. Also, according to financial theory, having too little and too much debt both involve significant risks and costs. But if we want to just focus on the firm's capacity to service long-term debt, then we would want to make sure that its debt ratio is not significantly higher than that of its competitors or the industry average.

8. Times interest earned = earnings before interest and taxes / interest expense

Times interest earned or TIE, sometimes also referred to as interest coverage ratio, reflects the firm's ability to meet interest payments on debt. In the income statement, earnings before interest and taxes (EBIT) is the item from which interest expense is deducted, so a TIE of at least 1 meas that the firm has interest "fully covered."

Caveat: We should however remember that interest is not the only obligation that arises from borrowing money. Often, the firm also needs to make periodic principal payments, particularly for amortized loans or bond issues with sinking fund provisions, so we should also consider these in our analysis.

Profitability ratios

9. Net profit margin = net profit / sales

Essentially, the net profit margin is a measure of how well a firm is able to control costs to maximize profitability, so typically, a firm with a consistently high net profit margin is a sign of good financial management.

Caveat: However, we must take care not to focus too much on costs at the expense of other aspects of the business. For example, some managers may be tempted to use cheaper, sub-standard materials in production or forego "costly" human resource development programs in an effort to boost profitability, but in the long run these actions may actually do more harm than good to the firm.

10. Return on total assets = net profit / total assets

Return on total assets or ROA measures the profitability of the firm's investments in assets regardless of how these assets were finance. Businesses of course work to improve their ROAs through the efficient use of resources (i.e., by improving the total asset turnover ratio) and/or by controlling costs (i.e., by improving the net profit margin). A relatively high ROA reflects efficient operations and a sound business model.

Caveat: Because "total assets" is in the denominator, the ROA suffers from the same limitations as other similar ratios in that firms with highly depreciated assets would have superficially high ROAs.

11. Return on common equity = net profit / shareholder's equity

Unlike ROA which does not take the source of the business' capital into consideration, return on common equity or ROE focuses on the profitability of the owners' investment in the business. Naturally, firms target a high ROE or a higher "bang for the buck" for common shareholders. Incidentally, ROE and "return on investment" or ROI are basically the same thing: the percentage of an investment that investors earn as profit. However, if many business persons and enthusiasts refer to ROI as the time it takes for an investment to be recovered; this quantity is actually not ROI but a commonly-used capital budgeting criteria called payback period.

Caveat: One way to mathematically or artificially get a higher ROE is by getting more debt. While "leveraging," to a certain extent, can amplify returns to the firm's owners, some costs like "financial distress" are not reflected by the numbers. Also, many cite ROE's limitations as an end-all measure of profitability, foremost of which is that it does not account for important factors like risk and time value of money.

There you have it, 11 financial ratios that you can use to evaluate the financial health of a business. Remember, these ratios only mean something when used in comparison with an appropriate benchmark. If you have time, you can download annual reports from the PSE website and try to perform your own analysis using these ratios.

In Part 1, we took a look at financial ratios that we can use to assess the capacity of a firm to meet its short-term obligations and its ability to use its resources to generate revenues. In this post, we will discuss ratios that we can use to evaluate the firm's ability to meet long-term financial obligations and earn returns from investments.

Debt management ratios

7. Debt ratio = total liabilities / total assets OR total long-term debt / total assets

The debt ratio, also often referred to as financial leverage, is simply a measure of how the firm's assets are financed. If you recall from our post about the balance sheet, a business has two main sources of long-term financing: debt and shareholders' equity (i.e., capital provided by the firm's owners). A high debt ratio indicates that a big portion of the firm's assets is financed by debt--which is really neither "good" nor "bad". To a great extent, a firm's debt level depends on its industry as some business models do well on little debt while others thrive on a higher financial leverage. Also, according to financial theory, having too little and too much debt both involve significant risks and costs. But if we want to just focus on the firm's capacity to service long-term debt, then we would want to make sure that its debt ratio is not significantly higher than that of its competitors or the industry average.

8. Times interest earned = earnings before interest and taxes / interest expense

Times interest earned or TIE, sometimes also referred to as interest coverage ratio, reflects the firm's ability to meet interest payments on debt. In the income statement, earnings before interest and taxes (EBIT) is the item from which interest expense is deducted, so a TIE of at least 1 meas that the firm has interest "fully covered."

Caveat: We should however remember that interest is not the only obligation that arises from borrowing money. Often, the firm also needs to make periodic principal payments, particularly for amortized loans or bond issues with sinking fund provisions, so we should also consider these in our analysis.

Profitability ratios

9. Net profit margin = net profit / sales

Essentially, the net profit margin is a measure of how well a firm is able to control costs to maximize profitability, so typically, a firm with a consistently high net profit margin is a sign of good financial management.

Caveat: However, we must take care not to focus too much on costs at the expense of other aspects of the business. For example, some managers may be tempted to use cheaper, sub-standard materials in production or forego "costly" human resource development programs in an effort to boost profitability, but in the long run these actions may actually do more harm than good to the firm.

10. Return on total assets = net profit / total assets

Return on total assets or ROA measures the profitability of the firm's investments in assets regardless of how these assets were finance. Businesses of course work to improve their ROAs through the efficient use of resources (i.e., by improving the total asset turnover ratio) and/or by controlling costs (i.e., by improving the net profit margin). A relatively high ROA reflects efficient operations and a sound business model.

Caveat: Because "total assets" is in the denominator, the ROA suffers from the same limitations as other similar ratios in that firms with highly depreciated assets would have superficially high ROAs.

11. Return on common equity = net profit / shareholder's equity

Unlike ROA which does not take the source of the business' capital into consideration, return on common equity or ROE focuses on the profitability of the owners' investment in the business. Naturally, firms target a high ROE or a higher "bang for the buck" for common shareholders. Incidentally, ROE and "return on investment" or ROI are basically the same thing: the percentage of an investment that investors earn as profit. However, if many business persons and enthusiasts refer to ROI as the time it takes for an investment to be recovered; this quantity is actually not ROI but a commonly-used capital budgeting criteria called payback period.

Caveat: One way to mathematically or artificially get a higher ROE is by getting more debt. While "leveraging," to a certain extent, can amplify returns to the firm's owners, some costs like "financial distress" are not reflected by the numbers. Also, many cite ROE's limitations as an end-all measure of profitability, foremost of which is that it does not account for important factors like risk and time value of money.

There you have it, 11 financial ratios that you can use to evaluate the financial health of a business. Remember, these ratios only mean something when used in comparison with an appropriate benchmark. If you have time, you can download annual reports from the PSE website and try to perform your own analysis using these ratios.

Friday, February 10, 2012

The PSEi at an All-Time High: Should We Wait?

DEAR INVESTOR JUAN

Dear Investor Juan,

I am a newbie in the area of investment and would really appreciate your advice.

I have an extra 100k pesos and have been toying around the idea of investing them on BPI Odyssey High Conviction Fund. I am not sure if there is a best time to invest them on such but would really appreciate your opinion whether I invest now when the psei is at it's all time high? Or wait? And should I split the 100k to invest in odyssey and some other fund?

Would really appreciate your help.

Thanks,

Tina

Dear Tina,

Thanks for your very timely question. Indeed, this current run of the stock market has elicited a lot of public interest in investing, in general, and investing in stocks, in particular. However, many would-be investors such as yourself intuitively have this idea that it's best to enter the market when prices are low and exit when prices are high. And since we have been experiencing all-time highs in stock prices in the past week couple of weeks, questioning the soundness of buying stocks or investing in equity funds now is well founded.

But let me first address your choice of funds: the BPI Odyssey High Conviction Fund. Looking at the fund's recent performance and composition, I would not advise you or anyone to invest in this fund for two simple reasons. First, from 2007, at the latest, to mid 2010, the fund has closely tracked the PSEi; since then, it has outperformed the benchmark by a significant margin. Looks good, right? Well, yes, if you bought in at the right time. But if you invest in the fund now, it's highly likely that the fund will go back to "normal" levels and just leave you with worse returns; this is based on the statistical concept of "reversion to the mean," which basically says that significant deviations from the norm or benchmark is not sustainable. In any case, the way I see it the excess returns that the fund has earned since 2010 is primarily due to higher risk, as evidenced by the disproportionate weight given to mining stocks in the fund (please see this post for my arguments against mining stocks), so we can't really say that this fund is better than other funds if we take both risk and return into consideration. Second, with a management fee of 2.50%, the fund charges at least double what "ordinary" equity funds charge; in my opinion, and based on some studies in the US, "expert" fund management more often than not does not deserve paying a premium for.

In short, I suggest that you keep it simple and just buy a run-of-the-mill equity fund that charges 1 to 1.25% per year, whenever you do decide to take the plunge.

Now let's talk about whether it's a good idea to invest in stocks now given that the PSEi is currently at (or has recently reached) it's all time-high. Last year when it was at 4,000, it seemed to me that the PSEi was "too high," and now we all know how wrong (although not necessarily unreasonable) that idea was. In any case, it's really impossible to perfectly time market entry or correctly predict what will happen to the stock market in the foreseeable future. That said, I will not leave you empty-handed. According to experts, indicators point towards a bull market and a continued rise in stock prices, so investing in stocks or any equity fund now may not be a bad idea. For conservatism, though, you might want to keep a portion of your funds as cash, "just in case," especially if you don't have an intact emergency fund yet.

So there, Tina. Go ahead and invest in a low-cost equity fund. Good luck. :)

Monday, February 6, 2012

11 Financial Ratios, Part 1: Liquidity and Asset Management Ratios

PERSONAL FINANCE 101

Our prior post about the price earnings ratio has generated some interest in other ratios that may also be used for investment and credit analysis. In this post, I will try to respond to this request by discussing a few simple and helpful financial ratios together with caveats or limitations in using and interpreting them.

In a nutshell, financial ratios are indicators of a firm's financial health and are ultimately used to evaluate a firm's future prospects. By themselves, these numbers mean very little--people who insist on "unbendable" rules (i.e., minimum or maximum values) for these ratios simply don't know what they are talking about (unfortunately, one can find a handful of these so-called experts in even the most prestigious universities in the country, but I won't mention names). To make sense of financial ratios, one must perform ratio analysis either by comparing a firm's ratio to the same ratio of its competitor(s) or to the industry average (cross-sectional analysis) or by analyzing how a particular ratio behaves over time (time series analysis).

Financial ratios may be loosely classified into the following categories:

Liquidity ratios - reflects the firm's ability to meet short-term financial obligations (i.e., those that are due within one year)

Asset management ratios - reflects how well the firm is able to use assets to generate sales

Debt management ratios - reflects the firm's capacity to meet its long-term financial obligations

Profitability ratios - reflects how well the firm is able to generate earnings from investments

Since eleven ratios are too long for one post and also because these two categories are very much related, we will just focus on liquidity and management ratios in this post.

Liquidity ratios

1. Current ratio = current assets / current liabilities

Technically, current assets (e.g., cash, accounts receivable, inventories, etc.) are those that are liquid--that is, those that may be converted into cash "quickly" (technically, within a year) at a level that is close to their fair values. Similarly, current liabilities (e.g., accounts payable, accrued expenses, etc.) are those which need to be paid within the year. So ideally, a firm should have enough current assets to cover its current liabilities--in other words, a current ratio of at least 1.

Caveat: While a current ratio that is greater than one may seem healthy, a current ratio that is high relative to an appropriate benchmark is often not good. A very high current ratio would mean one of two things: current assets are high relative to a certain amount of current liabilities, which is usually not good since this is an indication of an over investment in idle assets (remember, receivables are only good when they are collected and inventories when they are sold); or, that current liabilities are low given a level of current assets, which may mean that the firm is passing over possibly less expensive trade credit.

2. Quick or acid-test ratio = (cash + accounts receivable + other liquid current liabilities) / current liabilities

The quick ratio is based on the same principles (and is covered by the same limitations) as the current ratio, but is a more conservative measure since it excludes the least liquid current assets from the numerator (like inventories for many businesses).

Asset management ratios

3. Inventory turnover ratio = sales / inventories*

(*When comparing income statement items like sales to balance sheet items like assets, it's better to use the average value of the latter instead of the same-year figure, especially if year-on-year amounts vary greatly. For simplicity, though, we stick with using the same-year balance sheet amount.)

The inventory management ratio reflect's the firm's efficiency in converting raw materials to finished goods (for manufacturing firms) to sales. Generally, it is good to have a high inventory turnover ratio.

Caveat: A high inventory turnover ratio may mean that the firm is underinvesting in inventories, which may lead to higher inventory costs and lost sales.

4. Accounts receivable (A/R) turnover ratio = credit sales / accounts receivable

The accounts receivable turnover ratio is an indicator of how well the firm is able to collect receivables. A high A/R turnover ratio would often mean less cash tied to credit sales and therefore more cash-at-hand.

Caveat: One may be tempted to boost A/R turnover by not offering credit sales to customers and not accumulate receivables. But businesses offer credit terms to customers for one very important reason: to increase sales, since generally, more people would buy more if they have an option to buy on credit. So trying to increase the A/R turnover this way may actually hurt the company instead of help it.

Since the inventory turnover ratio and the accounts receivable turnover ratio also reflect the firm's ability to generate cash from the use of current assets, these ratios are sometimes also considered liquidity ratios.

5. Fixed asset turnover ratio = sales / net fixed assets

The fixed asset turnover ratio shows how efficiently the firm is able to generate sales from the use of fixed or long-term assets like real property, production facilities, and equipment, which may be considered direct capital inputs of production. A high fixed asset turnover ratio is generally considered a positive sign of the firm's financial health.

Caveat: The denominator--net fixed assets--is total fixed assets less accumulated depreciation. Therefore, a high fixed asset turnover ratio may just mean that the firm is using highly depreciated and inefficient equipment and that the firm's production is not as efficient as the ratio indicates.

6. Total asset turnover ratio = sales / total assets

The total asset turnover ratio is just the aggregate of the three asset management ratios above: it reflects the firm's efficiency in using all of its resources--its assets--to generate sales. Just like the fixed asset turnover ratio, a high total asset turnover ratio would generally mean highly efficient operations; however, this ratio also suffers from the same caveat that results from the inclusion of depreciation in the denominator.

Liquidity and asset management ratios go hand in hand in that they reflect the efficiency of the firm's operations--specifically its ability to generate sales from using its resources--and its capacity to use the resulting asset inflows to meet short-term financial obligations. In Part 2, we will take a look at other aspects of the firm's financial well-being when we discuss debt management and profitability ratios.

Our prior post about the price earnings ratio has generated some interest in other ratios that may also be used for investment and credit analysis. In this post, I will try to respond to this request by discussing a few simple and helpful financial ratios together with caveats or limitations in using and interpreting them.

In a nutshell, financial ratios are indicators of a firm's financial health and are ultimately used to evaluate a firm's future prospects. By themselves, these numbers mean very little--people who insist on "unbendable" rules (i.e., minimum or maximum values) for these ratios simply don't know what they are talking about (unfortunately, one can find a handful of these so-called experts in even the most prestigious universities in the country, but I won't mention names). To make sense of financial ratios, one must perform ratio analysis either by comparing a firm's ratio to the same ratio of its competitor(s) or to the industry average (cross-sectional analysis) or by analyzing how a particular ratio behaves over time (time series analysis).

Financial ratios may be loosely classified into the following categories:

Liquidity ratios - reflects the firm's ability to meet short-term financial obligations (i.e., those that are due within one year)

Asset management ratios - reflects how well the firm is able to use assets to generate sales

Debt management ratios - reflects the firm's capacity to meet its long-term financial obligations

Profitability ratios - reflects how well the firm is able to generate earnings from investments

Since eleven ratios are too long for one post and also because these two categories are very much related, we will just focus on liquidity and management ratios in this post.

Liquidity ratios

1. Current ratio = current assets / current liabilities

Technically, current assets (e.g., cash, accounts receivable, inventories, etc.) are those that are liquid--that is, those that may be converted into cash "quickly" (technically, within a year) at a level that is close to their fair values. Similarly, current liabilities (e.g., accounts payable, accrued expenses, etc.) are those which need to be paid within the year. So ideally, a firm should have enough current assets to cover its current liabilities--in other words, a current ratio of at least 1.

Caveat: While a current ratio that is greater than one may seem healthy, a current ratio that is high relative to an appropriate benchmark is often not good. A very high current ratio would mean one of two things: current assets are high relative to a certain amount of current liabilities, which is usually not good since this is an indication of an over investment in idle assets (remember, receivables are only good when they are collected and inventories when they are sold); or, that current liabilities are low given a level of current assets, which may mean that the firm is passing over possibly less expensive trade credit.

2. Quick or acid-test ratio = (cash + accounts receivable + other liquid current liabilities) / current liabilities

The quick ratio is based on the same principles (and is covered by the same limitations) as the current ratio, but is a more conservative measure since it excludes the least liquid current assets from the numerator (like inventories for many businesses).

Asset management ratios

3. Inventory turnover ratio = sales / inventories*

(*When comparing income statement items like sales to balance sheet items like assets, it's better to use the average value of the latter instead of the same-year figure, especially if year-on-year amounts vary greatly. For simplicity, though, we stick with using the same-year balance sheet amount.)

The inventory management ratio reflect's the firm's efficiency in converting raw materials to finished goods (for manufacturing firms) to sales. Generally, it is good to have a high inventory turnover ratio.

Caveat: A high inventory turnover ratio may mean that the firm is underinvesting in inventories, which may lead to higher inventory costs and lost sales.

4. Accounts receivable (A/R) turnover ratio = credit sales / accounts receivable

The accounts receivable turnover ratio is an indicator of how well the firm is able to collect receivables. A high A/R turnover ratio would often mean less cash tied to credit sales and therefore more cash-at-hand.

Caveat: One may be tempted to boost A/R turnover by not offering credit sales to customers and not accumulate receivables. But businesses offer credit terms to customers for one very important reason: to increase sales, since generally, more people would buy more if they have an option to buy on credit. So trying to increase the A/R turnover this way may actually hurt the company instead of help it.

Since the inventory turnover ratio and the accounts receivable turnover ratio also reflect the firm's ability to generate cash from the use of current assets, these ratios are sometimes also considered liquidity ratios.

5. Fixed asset turnover ratio = sales / net fixed assets

The fixed asset turnover ratio shows how efficiently the firm is able to generate sales from the use of fixed or long-term assets like real property, production facilities, and equipment, which may be considered direct capital inputs of production. A high fixed asset turnover ratio is generally considered a positive sign of the firm's financial health.

Caveat: The denominator--net fixed assets--is total fixed assets less accumulated depreciation. Therefore, a high fixed asset turnover ratio may just mean that the firm is using highly depreciated and inefficient equipment and that the firm's production is not as efficient as the ratio indicates.

6. Total asset turnover ratio = sales / total assets

The total asset turnover ratio is just the aggregate of the three asset management ratios above: it reflects the firm's efficiency in using all of its resources--its assets--to generate sales. Just like the fixed asset turnover ratio, a high total asset turnover ratio would generally mean highly efficient operations; however, this ratio also suffers from the same caveat that results from the inclusion of depreciation in the denominator.

Liquidity and asset management ratios go hand in hand in that they reflect the efficiency of the firm's operations--specifically its ability to generate sales from using its resources--and its capacity to use the resulting asset inflows to meet short-term financial obligations. In Part 2, we will take a look at other aspects of the firm's financial well-being when we discuss debt management and profitability ratios.

Friday, February 3, 2012

Happy Second Birthday to Us!

Time does fly when you're having fun, doesn't it?

Our second year may be best described as a year of GROWTH, with 4 times as many unique visitors and page views as our first year. Not only is there more of YOU, you also read more posts and spend more time on the website than the same period last year. By any measure, this would be considered a tremendous success, and it's all thanks to YOUR continued readership, comments, and participation. And last but not the least, I also want to thank those who were kind enough to share their ideas and experiences with us: Kat, Renzie, and Anonymous.

So what's in store for Year 3? I'll try my best to write more timely, practical, and informative posts, of course. Maybe a new look? And this year I'm going to form a team that's going to work on a BIG project, so let's keep our fingers crossed for that. Finally, and most importantly, I wish everyone better investment returns in the year ahead. :)

Most Popular Posts

5. Investing with US Dollars in the Philippines (Part 2: US Dollar Unit Investment Trust Funds)

4. 6 Steps: A Guide for Newbie Investors (Part 1)

3. Is Now a Good Time to Invest in Stocks?

2. 4 Important Benefits of Banco de Oro's Easy Investment Plan

1. Investing in Philippine Stocks, Part 1: The Basics