Wednesday, November 30, 2011

Monday, November 28, 2011

How Much Are You Worth? (Part 2)

In Part 1, we talked about why it is important to have an estimate of your worth and how to determine the value--specifically, the market value--of the things that you own.

However, you are not just worth what you own: your potential to generate future earnings--your human capital--is an asset that significantly contributes to your value.

Human capital

In computing for the value of your human capital, you need to have an estimate for the following things:

- Your total salary and other monetary benefits in the latest year, after taxes. You can include bonuses if you think these will reliably recur year after year.

- How much your non-monetary benefits are worth per year, excluding SSS/GSIS or any pension plan benefits. These will already be implied in the simple model that we are going to use.

- Your annual expenses. You can get this figure from your monthly budget plan, if you have one.

- The rate at which your annual salary (and expenses) will grow per year, on average.

- Your discount rate, or how much interest rate per year you can earn from your investments, on average. To be conservative, you can just use the prevailing after-tax yield of high-grade corporate bonds, which should be 5 to 6%.

Conceptually, your human capital is just equal to the present value of your expected future after-tax earnings, less expenses. To simplify the computation, we can just assume that you'll get wages practically forever, using your pension in lieu of your salary after retirement, and use the constant growth present value formula.

Human capital = PV of (future annual earnings - expenses)

Human capital = (current annual earnings - expenses)(1 + salary growth rate)/(discount rate - salary growth rate)

Please note that this simplified model will only work if your discount rate is greater than your salary growth rate; if its the other way around, if you think your salary will grow at a higher rate than what you can earn from investments, then your human capital would be infinite which, needless to say, is quite unrealistic. Of course, if you are already familiar with the concept of time value of money, you can always use a more detailed approach in computing for your human capital.

Your assets thus consists of your physical assets (e.g., house, car, jewelry, etc.), financial assets (e.g., stocks, bonds, UITFs, etc.), and human capital.

Your liabilities are what you owe other people, banks, or other credit providers. It includes your credit card balance, personal loans, car loans, and housing loans, among other things.

Your net worth is just the difference between your total assets and total liabilities; in other words, it's what remains after you have completely paid off everything you owe.

Net worth = total assets - total liabilities

Finally, to better understand how all this works, let's take a look at an actual example.

Problem

Pepe is a single, 25 year-old male. His gross salary of 35,000 per month is taxed at 20%, although his 13th month pay is tax exempt. On top of this, he gets additional non-monetary benefits of around 3,000 pesos per month.

Pepe is quite a frugal guy. On any given month, he makes it a point to save 30% of his after-tax monthly salary and all of his 13th month pay. And because of his hard work, Pepe estimates that his total earnings per year, after taxes and all expenses, may grow by at least 3% per year.

Pepe does not own much. He bought a second-hand car exactly one year ago by paying an 80,000 peso down payment and taking out a 300,000 peso car loan. Today, he owes the bank 250,000 pesos, but he just found out that his car is now just worth 300,000 pesos. Pepe's only other valuable property is a rare toy robot that he received as a gift 20 years ago; the same toy is now selling for around 20,000 pesos on eBay.

Pepe owns some UITF units, currently worth around 50,000 pesos. The price of this particular UITF has risen by an average of 7% per year in the past 10 years. Pepe also knows how to use his credit card wisely, so he uses it for purchases of around 7,000 pesos per month and always pays the entire balance on time.

Given the information above, what is Pepe's net worth?

Try this out first. I will post my solution in the comments section next week. :)

Thursday, November 24, 2011

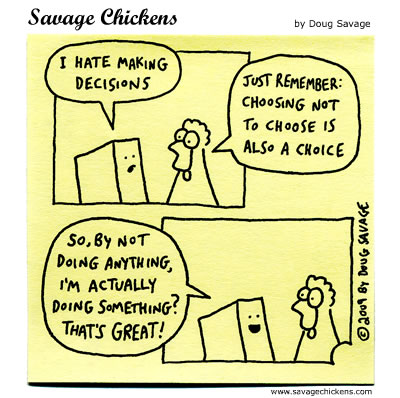

How to Make Good Decisions

Contrary to what some of you might think, understanding how people make decisions is an important aspect of successful investing and is thus very relevant to the main thrust of this blog. If we think about it, "investing" really is just a series of "buy" and "sell" decisions, specifically: what assets to buy or invest in, when to invest, and eventually, when to sell. Also, understanding the psychology of the typical investor--how the "crowd" thinks and how it reacts to shocks and new information--is key in devising an effective investment strategy. Finally, the ideas that I present and discuss in this space may actually also be applied to decisions of all kinds, from the mundane (e.g., how to decide which pair of pants to wear today) to the fun (e.g., whether to call, raise, or fold) to the life-changing (e.g., how to choose a wife).

Our aim in discussing and learning these concepts is, first and foremost, to become good decision makers. A good decision is one that is based on logic, and considers all available data and possible alternatives. Please do take note that by "good decision," I don't necessarily mean "the right decision" as no matter how well or systematic one goes through the decision making process, outcomes may still be unexpected or unfavorable. But regardless of the outcome, a decision that is "made properly" is still a good decision.

Normative vs. descriptive decision theories

There are two main approaches in studying decision making: the normative approach and the descriptive approach. The normative or prescriptive approach delves into how people are supposed to make decisions, assuming they are fully informed, able to compute with perfect accuracy, and fully rational--characteristics of an "ideal" decision maker. This approach is generally quantitative in nature and is heavily based on the academic fields of mathematics, operations research, and economics. And because the underlying assumptions of this approach are ultimately unrealistic, many find its associated theories to be of little practical import.

The descriptive approach, on the other hand, deals with how people actually make decisions; it covers the ideas that we have discussed in the Pop Quiz post and is the basis for many important developments in behavioral finance and economics. Descriptive decision theories are mainly based on behavioral and psychological concepts and usually rely on experimental evidence for support.

How does one actually make "good" decisions?

While there is no foolproof way of always getting the best outcomes, it is possible to always make decisions that make sense. Good decisions are those that (roughly) follow these steps.

1. Identify all available alternatives. In poker, each decision stage may be broken down to the following choices: give up and fold, call or meet the current bet, or raise the bet. In most real life situations however, alternatives are not as obvious and clear cut as that; it therefore pays to spend some time to figure out all the alternatives you may choose from, maybe even after some form of initial screening. Nothing is worse than failing to consider what would later turn out to be the best alternative (or even just a really good one).

2. Determine the costs and benefits of alternatives. In finance, when we choose between stocks and bonds, for example, we consider the trade off between the risk of a loss and potential returns. The same is true of most other cases: alternatives entail rewards and costs that we both should consider in making our choice.

3. Identify uncontrollable or unpredictable circumstances that may affect the payoffs of alternatives. What makes decision making so complicated is that it often involves uncertainty, usually about something that may happen in the future that will affect the value of our alternatives. In poker, it is the chance that the river card is a heart that will complete our flush. In investing, it is the possibility that policy makers in the Eurozone will finally get their act together and give stock markets around the world some much needed breathing room. The tricky part is that it is often not enough to know what may happen; most times, having some measure of the likelihood that something will happen is even more important.

4. Evaluate alternatives using some criteria or rule and make a decision. Normative decision theory tells us to use criteria like "expected value" or "expected utility" in making decisions; descriptive decision theory shows us that we don't actually like using these criteria, but rather rules of thumb or heuristics. In most cases, the specific criteria or rule that you use does not matter--as long as you use one. Ultimately, having some basis for making a choice is what separates good decisions from the bad.

Labels:

Making Decisions

Tuesday, November 22, 2011

The Economics of Beauty

It seems that some of you should just stop whatever it is you're doing: it is all for naught. It turns out that beauty and good looks are a significant determinant of happiness and success. According to this study by economist Daniel S. Hamermesh, "plain people" earn less than the average-looking people, who in turn earn less than the good looking ones, regardless of gender. What's more, unattractive women are more likely to be unemployed and marry "men with less human capital" (economist-speak for poor, lazy slobs). Here's Dr. Hamermesh in the flesh, as he discusses this prevalent form of employer discrimination on The Daily Show.

Of course, all this is related to Dr. Hamermesh's other study that shows how more attractive university instructors and professors are rated significantly higher by students. Should I show you how highly my students rated me when I was still teaching? :P

Friday, November 18, 2011

How Much Are You Worth? (Part 1)

Apart from tracking your periodic expenses, it is also important to have an estimate for your net worth at any point in time. While it is common for people to have cash milestones over their lifetimes (who wants to be a millionaire?), it is often more practical to have a "net worth" or "net value" target instead, especially given the significant opportunity costs associated with holding too much cash. Knowing your current net worth gives you an idea of how far you are from your financial goal and how much more you have to work to reach that goal, taking into account how many of us actually owe more than we own (see cartoon above). Also, a net worth estimate gives you a realistic measure of how much cash you can readily raise in case of an unforeseen need.

Estimating your net worth involves constructing some sort of personal balance sheet, which should very similar to the "statement of assets and liabilities" that we often hear associated with delinquent politicians and government officials. There are two key differences between this personal balance sheet and the actual balance sheet of a business or an individual's statement of assets and liabilities:

- We record assets and liabilities based or their current market value and not on their historical or acquisition cost

- Apart from financial and real assets, we also consider human capital--how much one's future earning potential is worth today

Market value vs. acquisition cost

The generally-accepted accounting practice is to record the acquisition cost of assets and just deduct an estimated deterioration in value--a practiced referred to as adjusting for depreciation. While it is often practical to use this method to record assets, at times the difference between this value and an asset's current market value--the price one can get if one sells the asset today--could be substantial. And since what we are interested in is how much money we can actually get for our assets at any given time, and not the amount we paid for the asset when we bought it (which is, in most instances, irrelevant information, if you recall one of the points in our previous post), it is more practical to use market values instead of historical costs.

One downside of using market values is that it is sometimes easier said than done. While the market value of some assets (such as cash, shares of stock, bonds, and investments in UITFs or mutual funds) are freely and publicly available, estimating the current worth of other assets like personal property (e.g., vehicles, jewelry, artwork) and real property may take a bit more effort and guesswork. The simplest way to estimate the market value of such assets is checking how much similar items are going for in the market. We can look at classifieds and publications like Buy & Sell for recent price information. If you have property in Sta. Rosa, Laguna, for example, then check how much similar properties nearby are going for per square meter, then just adjust according to the size of your own property. We can also turn to auction websites like eBay and Sulit.ph for this information.

If current market prices are difficult to come by, then you can just always resort to the acquisition cost method. If you think your asset loses a portion of its value over time due to use or natural wear and tear, then you can estimate it's current value using this formula:

Value = acquisition cost - (number of years you have used the asset / useful life of the asset)*acquisition cost

= acquisition cost [1 - (number of years you have used the asset / useful life)]

Where

Acquisition cost / useful life = annual depreciation

If you decide to use these formulas, you have to estimate how long you can use the asset (i.e., useful life, in years) and assume that it will be worth nothing at the end of its useful life.

Of course, if you know a bit about the mathematics of finance and the time value of money, you can always use the discounted cash flow (DCF) approach, where the current worth of an asset is just equal to the present value of the future cash flows that it is able to generate.

In Part 2, we will discuss human capital--what it is and how to estimate its value--and common items that are found on a personal balance sheet.

Labels:

Budgeting

Monday, November 14, 2011

Pop Quiz Results: A Closer Look at How We Make Decisions

The point of this exercise is to demonstrate the way we make decisions and the rules of thumb or heuristics that we employ--often subconsciously--whenever we face situations with only incomplete or imperfect information.

Nine have dared face the challenge. Let's see how these brave souls have fared.

1. A town has two schools: one large and one small. Assuming there is an equal number of boys and girls born every year in the Philippines, which school is more likely to have close to 50 percent girls and 50 percent boys born on any given day?

A. The larger

B. The smaller

C. About the same (say, within 5 percent of each other)

The obvious answer is C since, by intuition, the size of the school should not matter much, if at all. However, if we recall our college or high school statistics, the size of the sample does matter: the bigger the sample is, the more likely our estimate is closer to the actual value (more specifically, the variance of all possible estimates is inversely proportional to the sample size); therefore, the correct answer is A (6 of 9). The infuriating thing about statistics is that important relationships like this don't make a lot of sense at first glance, so are easily taken for granted by people, especially in real world situations.

2. A team of psychologists performed personality tests on 100 professionals, of which 30 were engineers and 70 were lawyers. Brief descriptions were written for each subject. The following is a sample of one of the resulting descriptions:

Juan is a 45-year-old man. He is married and has four children. He is generally conservative, careful, and ambitious. He shows no interest in political and social issues and spends most of his free time on his many hobbies, which include home carpentry, sailing, and mathematics.

What is the probability that Jack is one of the 30 engineers?

A. 10–40 percent

B. 40–60 percent

C. 60–80 percent

D. 80–100 percent

Since 30 out of the 100 professionals that were interviewed are engineers, the probability that Jack is an engineer is 30%, so the correct answer is A (5 of 9). The reason why some people would think of a higher probability is that they associate the characteristics mentioned in the given description--like being interested in carpentry, sailing, and mathematics--to being an engineer, even if no actual data supports such an association. This rule of thumb is called the representativeness heuristic.

3a. How many dates did you have last month?

A. 1–3

B. 3–5

C. 0

3b. On a scale of 1 to 5, how happy are you these days (5 being the happiest)?

A. 1

B. 2

C. 3

D. 4

E. 5

It should be obvious that this one doesn't have a correct answer; the point of these two questions is to demonstrate that the first question can easily influence our answer to the next. From the answers of our respondents, we see that a higher number of dates in 3a would likely lead to greater happiness in 3b, and vice versa. However, if the order of the questions were reversed, it's highly likely that responses to the happiness question would have little correlation with the dating question. This demonstrates that how questions or alternatives are presented do affect decision making, even if decision theory tells us that they should not. This phenomenon is referred to as the framing effect.

4. Imagine that you decided to see a play and you paid 500 pesos for the admission price of one ticket. As you enter the theater, you discover that you have lost the ticket. The theater keeps no record of ticket purchasers, so the ticket cannot be recovered. Would you pay 500 pesos for another ticket to the play?

A. Yes

B. No

This question demonstrates two important concepts in decision making. The first is the concept of the sunk cost: that is, past, irrecoverable costs should be irrelevant in decision making. In this situation, the lost ticket would definitely qualify as a sunk cost, so if one really wants to watch the play, then one should not hesitate to pay for another ticket, an alternative which most of our respondents have chosen (6 of 9). However, to a great degree the answer to the question is a matter of personal choice, so there really isn't a correct answer to this question.

We can also use the question to illustrate how framing works. Experiments show that most people would actually choose not to buy a ticket, an indication that people do consider sunk costs in making decisions. If you answered "no" to the question, then consider this analogous scenario:

Imagine that you decide to see a play and you will pay 500 pesos for the admission price of one ticket at the door. As you enter the theater, you discover that you have lost a 500 peso bill. Would you still pay 500 peso for a ticket to the play?

Experiments show that people who answer "no" to the first question would often answer "yes" to the second; this does not make a lot of sense since the two situations are the same and represent the same economic loss of 500 pesos, albeit expressed or framed differently. It's like agreeing to buy a glass that's half-full for a certain price, then refusing to buy a half-empty glass for the same price.

5a. Choose between getting 9,000 pesos for sure or a 90 percent chance of getting 10,000 pesos.

A. Getting 9,000

B. 90 percent chance of getting 10,000

5b. Choose between losing 9,000 for sure or a 90 percent chance of losing 10,000.

A. Losing 9,000

B. 90 percent chance of losing 10,000

Again, these two questions have no definite correct answer, but are used to demonstrate that people often weigh gains and losses differently. Actual experimental data (I have actually always asked my finance students to answer these two questions) show that respondents tend to answer A and then B (7 out of 9 of you did :)); this result is anomalous since choosing A in the first question is a sign of risk aversion while choosing B in the second question is indicative of risk-seeking behavior. In other words, we can't simply classify decision makers as being "risk averse" or "risk seeking," as traditional decision theory tells us, since individuals can easily avoid risk in a particular situation, then seek it in another, or vice versa. This phenomenon is referred to as prospect theory.

These questions come from a Vanity Fair feature on Nobel Laureate Daniel Kahneman who, together with Amos Tversky, paved the way for behavioral finance/economics/decision making into becoming popular fields of academic research and pretty much debunked the myth of the rational decision maker and the economic theories that are based on this assumption.

Next week, we'll talk more about the heuristics and anomalies that we talked about in this post, and a few others that we have not covered.

It's not enough to just know how people should make decisions: it pays to also know how people actually do.

Labels:

Making Decisions

Thursday, November 10, 2011

Pop Quiz

1. A town has two schools: one large and one small. Assuming there is an equal number of boys and girls born every year in the Philippines, which school is more likely to have close to 50 percent girls and 50 percent boys born on any given day?

A. The larger

B. The smaller

C. About the same (say, within 5 percent of each other)

2. A team of psychologists performed personality tests on 100 professionals, of which 30 were engineers and 70 were lawyers. Brief descriptions were written for each subject. The following is a sample of one of the resulting descriptions:

Juan is a 45-year-old man. He is married and has four children. He is generally conservative, careful, and ambitious. He shows no interest in political and social issues and spends most of his free time on his many hobbies, which include home carpentry, sailing, and mathematics.

What is the probability that Jack is one of the 30 engineers?

A. 10–40 percent

B. 40–60 percent

C. 60–80 percent

D. 80–100 percent

3a. How many dates did you have last month?

A. 1–3

B. 3–5

C. 0

3b. On a scale of 1 to 5, how happy are you these days (5 being the happiest)?

A. 1

B. 2

C. 3

D. 4

E. 5

4. Imagine that you decided to see a play and you paid 500 pesos for the admission price of one ticket. As you enter the theater, you discover that you have lost the ticket. The theater keeps no record of ticket purchasers, so the ticket cannot be recovered. Would you pay 500 pesos for another ticket to the play?

A. Yes

B. No

5a. Choose between getting 9,000 pesos for sure or a 90 percent chance of getting 10,000 pesos.

A. Getting 9,000

B. 90 percent chance of getting 10,000

5b. Choose between losing 9,000 for sure or a 90 percent chance of losing 10,000.

A. Losing 9,000

B. 90 percent chance of losing 10,000

*** END OF QUIZ ***

Please post your answers on the comments sections below. On Monday I'll tell you what this is all about, so finished or not finished, pass your papers! If you already know what this is, please don't spoil it for the others--thanks in advance--and just state your answers on the comments section.

Labels:

Making Decisions

Monday, November 7, 2011

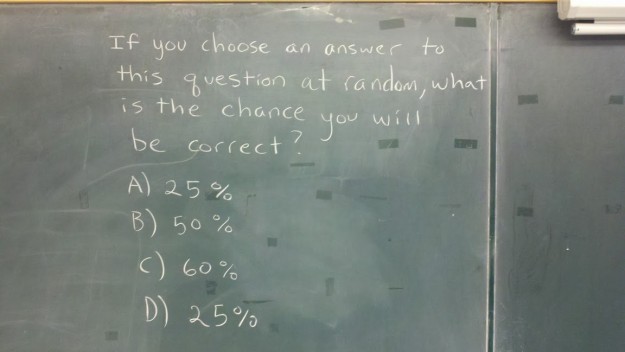

My Take on the Best Statistics Question Ever

A difficulty that students often face is that exam questions like this may be interpreted a number of ways, with each interpretation leading to a distinctly different answer. In this post, I offer two such interpretations.

The first leads to the same answer as one of our readers: "0% the correct answer is not among the choices." Here we assume that the question that needs a correct answer is "what is the chance you will be correct," and that you would only be "correct" if the probability of picking your answer is the same as the value of your chosen answer.

Say, you randomly pick "25%". Since two out of the four choices represent "25%", then the probability of randomly picking it is 50% (assuming equal likelihood). And since your answer--25%--is not the same as the probability of picking your answer--50%--then you will have been incorrect.

Using the same logic, it's easy to see how picking the other two available choices, 50% and 60%, would also be incorrect. This means that the chance that you will be correct is zero--there is no chance that you will be right!

Of course, if you read the problem differently, you should arrive at a different answer. For example, if we assume that "being correct" refers to some other arbitrary question, that the choices pertain to that question and not to the chance that your answer will be correct, and that one of the given choices is the correct answer, then we'll arrive at an altogether different solution.

We are still interested in the probability of randomly picking a correct answer, but this time we do not limit this probability to the given choices. We could go through equations and basic laws of probability to solve the problem, and in the end we'll most probably arrive at the correct solution, but there is a simple way of reasoning out the correct solution instead.

First we recognize that there are only three possible answers to the problem: 25%, 50%, and 60%. If we assume that the three are equally likely to be the correct answer, then the probability that each will be correct is 1/3. Or,

- If C = the correct answer, where C = 25%, 50%, or 60%. Assuming these choices are equally likely to be correct, then the probability of C, P(C = 25%) = P(C = 50%) = P(C = 60%) = 1/3.

Since the probabilities are all the same, then the actual choice we pick does not matter: whatever we choose, the probability that it will be the correct answer is 1/3.

Can you think of another approach to solving the problem? Feel free to share your thoughts in the comments section below.

Labels:

Making Decisions

Thursday, November 3, 2011

Subscribe to:

Posts (Atom)